SPY

SPY

(0.5%)

(0.5%)

XLV

XLV

(-0.22%)

(-0.22%)

QQQ

QQQ

(0.34%)

(0.34%)

VTI

VTI

(0.45%)

(0.45%)

GLD

GLD

(-1.81%)

(-1.81%)

XLF

XLF

(0.29%)

(0.29%)

XLI

XLI

(1%)

(1%)

XLB

XLB

(0.13%)

(0.13%)

XLY

XLY

(1.67%)

(1.67%)

XLP

XLP

(0.47%)

(0.47%)

XLE

XLE

(-0.52%)

(-0.52%)

XLK

XLK

(-0.12%)

(-0.12%)

XLRE

XLRE

(0.37%)

(0.37%)

XLU

XLU

(0.2%)

(0.2%)

Empowering your investments

Welcome to Spike Invest: Your Guide to Smart,

Simple Investing:

At Spike Invest, we believe that everyone should have the opportunity to invest wisely and grow their wealth, regardless of experience. We simplify the world of investing by focusing on Exchange Traded Funds (ETFs) and Index Funds—two of the most powerful tools for building a long-term, balanced portfolio.

Investing in themes you believe in empowers you

to shape the future while building your wealth

By supporting industries aligned with your passions, values, and

vision, you contribute to positive change

while potentially reaping the rewards of growth in areas you're

truly passionate about.

Key Options for Sharia-Compliant ETFs

Sharia-compliant ETFs are designed to meet the ethical and financial principles of Islamic law (Sharia), making them suitable for Muslim investors. These ETFs follow specific guidelines, such as avoiding investments in businesses related to alcohol, gambling, pork, and interest-based financial services. Instead, they focus on sectors and companies that align with Islamic principles.

An Introduction to ETFs: A Beginner’s Guide to Smart Investing

When you’re just starting out as an investor, the world of stocks, bonds, and mutual funds can feel overwhelming. For many new investors, the idea of picking individual stocks or constantly monitoring the market seems daunting. This is where Exchange-Traded Funds (ETFs) come in—a simple, effective way to invest in a wide range of assets without the complexity.

Investing vs. Speculation: Why Long-Term Investing is Better for Most People

When people think of making money in the stock market, they often imagine two things: quick, high returns and big risks. This thinking confuses two very different approaches to building wealth: investing and speculation. While both can be profitable, they carry distinct risks, goals, and strategies. Understanding these differences is key to making smart financial decisions, especially for people looking to grow their money steadily and securely over time.

The Surge in the AI Sector: Why NVIDIA is Leading the Charge

The Surge in the AI Sector: Why NVIDIA is Leading the Charge In recent years, the technology sector has witnessed tremendous growth, with one particular area standing out as a game-changer: Artificial Intelligence (AI). AI, once a futuristic concept, is now a driving force behind innovations across industries. From self-driving cars and healthcare diagnostics to smart home devices and financial algorithms, AI is transforming how we live and work. The recent surge in AI development has sparked excitement among investors, and one company has emerged as a leader in this space: NVIDIA. In this article, we’ll explore why the AI sector is booming, NVIDIA’s critical role in this growth, and what it means for investors and the future of technology. Why AI is Experiencing a Boom AI’s rapid rise can be attributed to several factors converging at the right time: 1. Increased Computing Power: AI requires vast computational resources to process data, run algorithms, and learn from patterns. Advances in hardware, especially GPUs (Graphics Processing Units), have made it possible to handle the immense processing needs of AI systems. As these technologies evolve, they allow AI models to become more sophisticated and effective. 2. Big Data Availability: AI systems thrive on data. With the explosion of data from smartphones, social media, cloud computing, and the Internet of Things (IoT), there’s more information than ever for AI algorithms to analyze and learn from. This data drives improvements in everything from recommendation engines to predictive analytics. 3. Enterprise and Consumer Demand: Companies across all sectors are seeking ways to leverage AI to improve efficiency, enhance customer experiences, and innovate in their products. AI’s ability to automate processes, make sense of large datasets, and provide insights is creating demand in industries like healthcare, finance, manufacturing, and beyond. 4. Breakthroughs in Machine Learning: Advances in machine learning (ML) and deep learning—subfields of AI—are allowing machines to perform tasks that once seemed impossible, like understanding human speech, recognizing images, and even generating creative content. These breakthroughs are pushing the boundaries of what AI can achieve. Why NVIDIA is Leading the AI Revolution As AI grows, NVIDIA has positioned itself as a dominant force in this rapidly expanding sector. Originally known for its role in the gaming industry, NVIDIA’s Graphics Processing Units (GPUs) have become the backbone of AI computing. But why has NVIDIA emerged as such a key player? 1. GPUs are Essential for AI: While traditional processors (CPUs) handle general computing tasks, GPUs are designed for parallel processing—meaning they can handle multiple tasks simultaneously. This capability is critical for AI and machine learning, where vast amounts of data need to be processed at once. NVIDIA’s GPUs are considered the gold standard in AI research and development, powering everything from self-driving cars to natural language processing models. 2. NVIDIA’s CUDA Platform: Beyond hardware, NVIDIA’s CUDA (Compute Unified Device Architecture) platform has become a vital tool for developers and researchers working on AI and machine learning. CUDA enables software to leverage the full power of NVIDIA’s GPUs, making it easier for developers to build and scale AI applications. This integration of hardware and software has helped NVIDIA carve out a unique and dominant position in the AI ecosystem. 3. Data Center Expansion: While NVIDIA started in the gaming space, the company has rapidly expanded into data centers, which are critical for AI processing. NVIDIA’s A100 and H100 GPUs are now widely used in data centers around the world, powering AI applications for major tech companies and research institutions. These high-performance GPUs are designed to handle AI workloads with efficiency, making NVIDIA the go-to provider for AI infrastructure. 4. Partnerships and Acquisitions: NVIDIA has strategically invested in AI-related partnerships and acquisitions. Its acquisition of Mellanox Technologies (for data center connectivity) and Arm Holdings (for chip design) has expanded its influence in the AI hardware space. By creating an ecosystem that supports AI development from chip design to cloud infrastructure, NVIDIA has secured its place as a key player in the AI surge. What’s Driving NVIDIA’s Recent Surge? NVIDIA’s recent stock surge is directly tied to the explosion of interest in AI. Several key developments have contributed to this rise: - AI Adoption Across Industries: NVIDIA’s GPUs are essential for AI, and as companies in healthcare, finance, automotive, and other sectors integrate AI into their operations, NVIDIA’s hardware is in high demand. The company’s products power the AI systems used in self-driving cars, predictive analytics, and personalized recommendation engines, to name a few. - The AI Arms Race: With AI becoming a competitive advantage, businesses are investing heavily in AI infrastructure to stay ahead. Tech giants like Google, Amazon, and Microsoft are pouring billions into AI research and development, and they rely on NVIDIA’s GPUs to build their AI systems. This “AI arms race” is fueling growth in the demand for NVIDIA’s products. - ChatGPT and Generative AI: The emergence of Generative AI technologies, like OpenAI’s ChatGPT, has driven further interest in AI. These AI models require massive computational resources to operate, and NVIDIA’s GPUs are the industry standard for training and running these large-scale models. As AI continues to advance, NVIDIA’s role in powering these systems solidifies its dominance. - Strong Financial Performance: NVIDIA’s impressive earnings reports have validated its growth story. The company has posted record revenue, driven by AI-related demand, and continues to show strong financial results in key sectors like data centers and gaming. Investors see NVIDIA as a leader in AI, and its stock performance reflects this confidence. What Does the Future Hold for AI and NVIDIA? The surge in AI is not a short-lived trend. AI is expected to continue transforming industries, and NVIDIA’s position as a leader in the field means it will likely benefit from this growth for years to come. - Expanding AI Use Cases: AI will continue to find new applications in areas like healthcare, robotics, and autonomous vehicles. NVIDIA is well-positioned to provide the hardware and software solutions necessary for these innovations. - Growth in AI Cloud Services: As more companies shift to cloud-based AI solutions, NVIDIA’s products will be essential in powering these services. Partnerships with cloud providers like Amazon AWS, Google Cloud, and Microsoft Azure further solidify NVIDIA’s influence in this space. - Innovations in AI Hardware: As AI models become more advanced, the demand for cutting-edge hardware will grow. NVIDIA’s continued investment in R&D ensures it remains at the forefront of AI technology, driving innovation in GPUs and other AI infrastructure. Conclusion The surge in the AI sector is one of the most exciting developments in the technology world, and NVIDIA is at the center of this transformation. With its powerful GPUs, software platforms, and strategic investments, NVIDIA has become the go-to company for AI computing. As AI continues to reshape industries and drive innovation, NVIDIA is positioned to be a key player in the future of technology, making it a stock to watch for investors and a company leading the charge in AI’s next frontier.

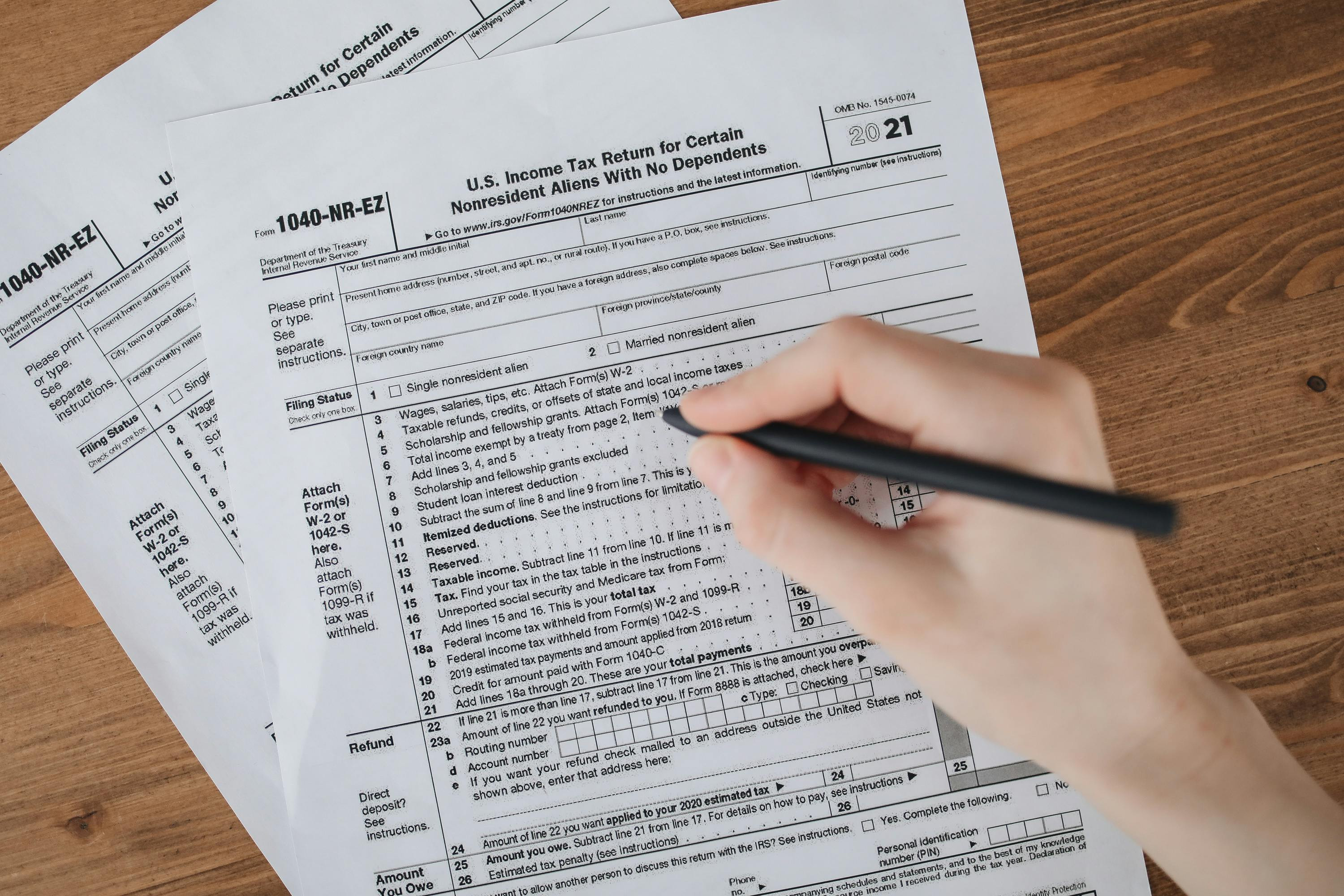

The Tax Efficiency of ETFs: Why They're a Smart Choice for Investors

One of the key advantages of Exchange-Traded Funds (ETFs) is their tax efficiency, which can help investors keep more of their returns. Here's why ETFs are more tax-efficient compared to other investment vehicles like mutual funds

Getting Easy Global Exposure with ETFs

ETFs offer a simple and cost-effective way to gain exposure to global markets, allowing you to invest in companies and economies worldwide with just a few trades. Here's how: Broad Global ETFs: ETFs like VT (Vanguard Total World Stock ETF) provide exposure to thousands of companies across both developed and emerging markets, giving you instant diversification without needing to pick individual stocks from multiple countries. Regional and Country-Specific ETFs: If you want more targeted exposure, there are ETFs that focus on specific regions or countries. For example, EFA (iShares MSCI EAFE ETF) focuses on developed markets outside North America, while FXI (iShares China Large-Cap ETF) gives access to leading Chinese companies. Emerging Market ETFs: For those looking to invest in fast-growing economies, ETFs like VWO (Vanguard FTSE Emerging Markets ETF) provide exposure to countries such as China, India, and Brazil, where rapid economic development offers significant growth potential.

Trump's 'big, beautiful bill' clears key Senate hurdle after high drama

The vote came after hours of uncertainty over whether the massive package could secure enough Republican votes to move to a final Senate vote.

The record-breaking week in the stock market that could have gone very badly

Incredible as that was, this week could have easily went another way.

Use the ‘80-10-10’ rule to know if you’ve found the right house, says real estate agent of 10 years

Looking to buy a home? Real estate agent Dana Bull shares the simple formula that can help you cut through the noise find the right house for you.

Why LGBTQ+ couples are racing to do estate planning right now: ‘I don’t know an LGBTQ person that isn’t nervous’

“Marriage gives you privilege. Estate planning gives you power,” said one estate-planning lawyer. Here are some LGBTQ-focused tips.

Gas prices are expected to fall: ‘It’s going to be the cheapest summer since 2021,’ one expert says

This summer could bring the lowest gas prices in years, with the national average falling below $3 a gallon as early as September, says one expert.

Actor Steve Carell says this personality trait is a 'very potent strength' that helped him succeed—CEOs and researchers agree

Actor and comedian Steve Carell says that the key to a successful career, and a better world, is kindness. Here's why he says the trait is so important.

AI could wipe out entire Wall Street teams. Here’s who will have staying power.

“The number of people used, whether it be a junior banker, analyst or a salesperson, you just don’t need to throw bodies at it anymore.”

‘I am horrified’: My company won’t allow me to tip more than 15% for Ubers. Do I explain this to the driver?

“I would never even consider tipping less than 20% if it were a personal ride.”

Can a baby bonus really make Americans have more kids? Here’s what big families say.

Americans are having fewer babies. These large families share how they’re making it work in this economy: Up at 4:45 a.m., driving a 12-passenger van, and no big vacations.

Tech stocks are powering this record-setting rally on Wall Street — but how long can it last?

Whether the record-setting stock rally is built to last may come down to one of the market’s most longstanding questions: How broad is the rally?

PwC plans cuts, lower pay rises on tougher market conditions

PricewaterhouseCoopers LLP is planning layoffs in the UK and lower salary increases amid a broader market slowdown, the Financial Times reports

Trump says Gaza ceasefire may be ‘close,’ possibly within week

He did not provide further details on how an agreement might unfold or say to whom he spoke about a possible halt in the war that began with the Hamas assault on Israel on Oct. 7, 2023.

S&P 500 hits record high after $10 trillion rally

Wall Street traders drive stocks to all-time highs amid tariff headlines, cooling West Asia risks, and US economic resilience.

Jim Cramer's week ahead: Labor report and earnings from Constellation Brands

CNBC's Jim Cramer on Friday guided investors through next week's market action.

Jim Cramer is not giving up on Apple. Here's why

CNBC's Jim Cramer told investors he's still pulling for Apple, even as its stock lags behind the averages.

Trump’s latest trade threat looms over Wall Street as investors celebrate stock market’s return to record territory

Major equity indexes including the S&P 500 tallied their first record closing highs in months on Friday — but something happened on the way to the closing bell that left a bad taste in some traders’ mouths.

Wells Fargo clears another Fed hurdle as banks pass stress tests

The U.S.’s largest banks remained “resilient” after absorbing $550 billion in losses in a simulated economic shock.

Republicans defend lucrative Medicaid scam

Guess who’s paying for the costs of hospitals and nursing homes in red states?

Will ‘F1’ help Apple finally win one in the movie and streaming race?

After years of middling success on the big screen, Apple has bet big on the racecar movie starring Brad Pitt with a budget of nearly $250 million.

Coinbase’s stock is up 44% this month as Wall Street projects amazing profit growth

The cryptocurrency-trading platform is expected to put up big numbers through 2027 at least.

Trump administration eyes cuts to student-loan forgiveness for public servants

The proposed regulatory text from the Education Department would ban certain employers from being eligible for Public Service Loan Forgiveness.

We're raising our price targets on 5 stocks — and cutting our outlook on another

Every weekday, the Investing Club releases the Homestretch; an actionable afternoon update just in time for the last hour of trading.

The $5 trillion company: Wall Street gets bullish on tech stocks this week

Nvidia and Microsoft were soaring as tech analysts keep releasing optimistic calls on the sector.

The AI portion of Trump’s megabill is drawing flak from both Republicans and Democrats. Here’s why they’re worried.

As President Donald Trump struggles to unite Republican lawmakers around his megabill, a range of provisions continues to divide the GOP — including one focused on artificial intelligence.

Trump calls New York Democratic mayoral candidate Zohran Mamdani 'a communist'

Some New York investors and business leaders are dismayed that democratic socialist Zohram Mamdani will become the next mayor of New York City.

What drove stock market’s record-breaking week? Don’t overlook growing rate-cut expectations.

Friday’s rally in U.S. stocks, which sent the S&P 500 to an intraday record high, was getting help from solidifying expectations of traders around the likelihood of at least three quarter-point rate cuts from the Federal Reserve by year-end.

Retirement ages are going up around the world — sending a signal to the U.S. workforce

Countries like Denmark and China show that innovation and investment are essential to meet the needs of people who are living and working longer.

The U.S. beer industry faces these ‘sheep, parasites and wolves,’ BofA says, as Molson gets a downgrade

The U.S. beer industry faces a retreat from health-conscious consumers and competition from alternative beverages.

Nike stock soars 17% after CEO soothes investors, says recovery is on the horizon

Nike investors finally have an answer from CEO Elliott Hill about how long its turnaround plan will take, boosting confidence that upside is ahead.

Jim Cramer says buy this bank stock — plus Street analyst names Meta a top pick

The Investing Club holds its "Morning Meeting" every weekday at 10:20 a.m. ET.

The Moneyist and the million-dollar retirement question

Also: An interview with Robinhood CEO Vlad Tenev, a soaring stock you might best avoid and how an annuity can help stabilize your retirement.

Deep inside U.S. economy, more sticker prices start going up due to tariffs, and inventory is headed down

Across U.S. distribution networks, inside retail and manufacturing warehouses, there's a widespread move to adjust prices higher due to tariffs.

My wife and I have $7,000 in pensions, $140,000 cash, plus $3,500 in Social Security. Can we afford to retire?

“My wife of 20 years is a Japanese national and lives in the U.S. as a permanent resident.”

Zohran Mamdani ran for VP of his high school and lost—now he's winning the Democratic primary for NYC mayor

Before Zohran Mamdani ever ran for mayor of New York, he lost his high school vice-president election at The Bronx High School of Science.

I’ve been a stay-at-home mom for 10 years. Do I take a part-time job to spend more time with my kids or get a job for six figures?

“So much of my head has been filled with thoughts of needing to be the best, the brightest, the wealthiest.”

I was married twice. Can I switch from my Social Security benefit to my ex-husband’s when he dies?

“I started collecting my own Social Security benefits at age 70.”

Robinhood’s Vlad Tenev has led a trading revolution to become a new Wall Street power

Backed by an army of retail traders, Vlad Tenev is shaking up the financial order.

Nike’s stock is headed for a ‘swoosh’-shaped recovery after years of pain, analyst says

Nike Inc. has endured a tough few years marked by weaker demand and its own struggles to adapt to shifting trends. While the athletic-gear and sneaker maker’s fourth-quarter results Thursday were hardly spectacular, analysts say that Nike is finally on a path to recovery.

4 AI tools to help with your side hustle: One ‘increased my website traffic by 30%,’ says expert

Claude AI is a generative AI tool that hustlers like Jen Glantz use to create social media strategies.

We're trimming our position in an outperforming stock we've battled for ages

The stock has bested the S&P 500 this year after a long period of being a drag on our portfolio.

New investment options may be coming to 401(k)s—here's what it means for your money

Experts say the addition of cryptocurrency or private equity to 401(k) rosters could put investors in risky territory.

Consumers cut spending on cars and other goods when tariffs kicked in. What will they do next?

Consumer spending falls in May for first time in four months

Jim Cramer's top 10 things to watch in the stock market Friday

The S&P 500 is eyeing a record high, and Nike might have reached the bottom.

Inflatio not showing much sign of tariff-tied increase, but Fed still not aiming to cut rates soon

The latest PCE report probably cements the status quo. Investors expect the Fed to wait until September to cut interest rates for the first time this year.

The U.S. and China just struck a deal on rare earths. This is why it’s easing trade tensions.

President Donald Trump said Thursday that a deal had been signed “yesterday” with China, but offered no details.

The S&P 500 is on the cusp of the seventh great breakout since the 1990s: BofA’s Hartnett

Risks for stocks seem to be fading as markets focus on rate cuts and tax cuts.

Why Americans fell out of love with the hotel minibar

For many prevalent midscale hotel chains, minibars are becoming a relic.

There’s an important market indicator that suggests investors remain wary. It’s good news for stocks.

Sector correlations are way above average as traders await clarification on a number of issues

Boeing is making a positive turn, says analyst upgrading stock to buy

Troubled plane maker Boeing was given an upgrade by an analyst who said a turnaround effort will get the market to reassess the stock.

JSW plans ₹4,000 crore debt sale to fund Akzo deal

Foreign banks including Barclays Plc, Mitsubishi UFJ Financial Group Inc and Standard Chartered Bank Plc will arrange the debt, which is expected to be denominated in rupee, sources said

India to see record rice crop even as reserves overflow

India's record rice surplus poses storage challenges, influencing global market prices and welfare programmes, with potential for further impact.

RBI drains $10 billion to lift short-term rates

RBI withdraws $10 billion to lift overnight borrowing costs, aiming to align rates with policy rate.

Iran dismisses Trump’s claim of nuclear talks resuming next week

While some Iranian officials including the president have indicated a readiness for talks, they face resistance from others who are especially opposed to engagement in the wake of the conflict.

HDB’s $1.5 billion IPO sold out as wealthy investors pile in

HDB Financial Services Ltd’s $1.5 billion initial public offering, one of India’s biggest this year, sold out amid demand from wealthy investors seeking to buy a piece of the shadow-lending unit of the country’s top private bank.

Indian REITs may stretch gains on RBI’s rate cuts, strong leasing

Nexus Select Trust, Mindspace Business Parks REIT, Embassy Office Parks REIT and Brookfield India Real Estate Trust return as much as 27% over last year

Alibaba elevates e-commerce chief, shrinks key leadership body

Those leaving the committee include high-profile veterans such as ex-CEO Daniel Zhang, co-founder Lucy Peng and former CFO Maggie Wu, part of an old guard who helped build Alibaba

Walmart-backed Flipkart turns to videos and livestream to woo Indian online shoppers

Data from Flipkart shows about 200 million users engaged with videos on the platform while shopping in the first half of 2025, up from 75 million a year ago

SpaceX crane collapse in Texas being investigated by OSHA

A SpaceX crane collapse at the company's Starbase, Texas facility has prompted an investigation by OSHA, the federal agency told CNBC.

McCormick is focused on mitigating tariff impact on agriculture, says CEO Brendan Foley

McCormick CEO Brendan Foley told CNBC's Jim Cramer on Thursday that the spice maker is looking at how new tariffs will impact sourcing for its products.

Jim Cramer: These S&P 500 winners demonstrate the market's broad success

CNBC's Jim Cramer reviewed Thursday's top S&P 500 performers to demonstrate that a broad group of stocks are seeing gains.

S&P 500 briefly tops record high for the first time in 4 months. What could push stocks higher from here?

The S&P 500 index briefly surpassed its all-time record high on Thursday — the latest development in what has been a remarkable comeback from the precipice of a bear market.

Nike’s results top estimates. But CEO says they’re still ‘not where we want them to be.’

Nike Inc. on Thursday reported fourth-quarter results that weren’t as bad as Wall Street expected, but the financials weren’t doing much for the sneaker maker’s stock in after-hours trade.

The Fed’s moves on interest rates aren’t just about Trump’s pick for chair. Here’s the math.

The Federal Reserve chair is one of 12 voters on the rate-setting committee. To what extent can the chair call the shots?

Few people are willing to pay for news online, which makes things tougher for the news industry

A new survey finds that only 17% of people are willing to pay to read news online, with most either looking elsewhere for the news for free or just not reading it at all.

QuantumScape’s stock is still on a tear, but buyer beware, analyst says

Baird’s Ben Kallo said he needs to see how QuantumScape plans to make money on its breakthrough EV battery-making technology before he gets bullish on the stock.

Tests of all the power needed to run AI chatbots back our case for 3 data center plays

Every weekday, the Investing Club releases the Homestretch; an actionable afternoon update just in time for the last hour of trading.

This cryptocurrency is bitcoin’s biggest challenger yet — and it just might take over your wallet

Stablecoins are testing the foundation of the financial system. The problem? How to regulate them.

Tesla head of manufacturing Omead Afshar fired by Elon Musk

Omead Afshar, Tesla's head of manufacturing and operations, has been fired from the company by CEO Elon Musk after declining car sales.

The child tax credit could be worth over $2,000 under Republicans' spending plan—but millions of families wouldn't benefit

Both the House and the Senate want to raise the maximum child tax credit, but limits on who can claim it mean millions of children still won't benefit.

This guy has 45 credit cards. Here’s what you can learn from his strategy.

Dave Grossman carries a “Costanza wallet,” and he says he’s reaped rewards aplenty as a result.

Chip stocks are reclaiming market leadership. Here’s why analysts are optimistic.

Nvidia’s stock closed at a new all-time high on Wednesday, while Micron delivered an earnings beat on AI-driven demand for its memory chips

How to reverse alarming education decline in U.S. and around the world: Teach for All founder Wendy Kopp

Wendy Kopp, CEO and founder of Teach For All and Teach for America, on what needs to change in the U.S. education system.

Wall Street is getting worried about United Airlines. Yes, it’s mostly about Newark airport.

United has a major hub at Newark Liberty International Airport, and Wall Street wonders just how much the late-spring communications problems and runway closure at the airport will weigh on the airline’s profits.

Why Micron shares are down after the chipmaker's big earnings beat and raise

The Investing Club holds its "Morning Meeting" every weekday at 10:20 a.m. ET.

Police detain six outside Palantir office at protest over deportations, military work

"Palantir's tech programs are being used to deport our neighbors, kill civilians in Gaza ... and deny health insurance claims," a group said.

What’s up with inflation? PCE likely to show a small rise in prices despite tariffs.

Higher inflation from tariffs is still expected to flow through the U.S. economy, but Wall Street investors aren’t expecting the price increases to show up this week.

I studied 400 highly successful leaders—5 skills you need to sharpen in the age of AI: Stanford expert

The rapid advancement of AI is redefining job roles and making adaptability more critical than ever. Robert E. Siegel, a lecturer at Stanford Graduate School of Business and the author of "The Systems Leader," spent 23 years studying how professionals can navigate disruptive changes. Here's his best advice.

Here’s what’s taking the S&P 500 so long to make a new all-time high

U.S. stock-market benchmark is making its way to a new record slowly — but it will get there.

Mortgage rates drop to a 7-week low, with investors optimistic about a Fed rate cut in July

Mortgage rates fell to a seven-week low this week, giving home buyers some reprieve from high borrowing costs, even as affordability remains strained.

An IPO from a collections company offers a fresh way to profit as consumers struggle

Jefferson Capital buys consumers’ troubled loans at a discount, then works with the consumers to have them paid back “based on their current financial circumstances.”

Trump takes aim at Powell and sends the U.S. dollar tumbling to a 3-year low

A potential “attempt to influence the Fed so directly” by announcing a successor to Jerome Powell well before his term expires “does not set well with investors,” notes one analyst.

Trump Medicaid cuts dealt major blow in Senate, imperiling tax bill

The Senate parliamentarian said Thursday that several major planned cuts to Medicaid violate the chamber’s own rules and must be reworked or abandoned.

What’s the downside of an assumable mortgage with a 2.5% interest rate? The house only costs $350,000.

“My friend’s son and his fiancée found a house with an assumable mortgage at 2.5%.”

Most American weddings are a lot more extravagant than the Jeff Bezos and Lauren Sanchez nuptials

The Amazon founder’s wedding may be ludicrously over the top by many people’s estimation, but it pales in comparison with the habits of Americans in love.

The blunder in Trump’s tax bill that may end up costing taxpayers more, not less

One of the biggest “savings” will come at the expense of 1.3 million Medicare beneficiaries.

Teens from upper-income families are far more likely to work summer jobs than poor teens. What’s going on?

Teen employment in the U.S. has been declining for decades. Today, many working teens today come from higher-income families that encourage them to seek learning opportunities outside of the classroom.

More Gen Zers are becoming bosses—and they're prioritizing flexibility and well-being

The share of managers who are Gen Z, who are as old as 28, hit 10% for the first time in April, according to new Glassdoor data.

Durable-goods orders post biggest gain in 11 years, but it doesn’t mean the economy is speeding up

Orders for long-lasting goods skyrocketed 16% in May to mark the biggest increase in 11 years, but the headline number was exaggerated by a flush of new Boeing contracts that masked ongoing weakness in business investment.

20 banks expected to increase their dividends the most following the Fed’s stress tests

Wells Fargo & Co., Goldman Sachs Group Inc. and Bank of New York Mellon Corp. top the list of 20 banks expected to boost their dividends in the coming quarter as capital deployments by the largest U.S. banks come into focus in the days ahead.

Why Europe’s most important semiconductor stock was downgraded

Chinese semiconductor demand may surprise analyst expectations to the dowenside in 2026

Tesla’s new No. 2 most bullish analyst sees a return to a $1.5 trillion market cap

Tesla’s transition from carmaker to high-tech robotics company is the reason a Benchmark analyst boosted his stock-price target to the second-highest on Wall Street.

This outlook shows why investors should maintain exposure to the ‘Magnificent Seven’

Big Tech is expected to see double the earnings growth of the S&P 500, as long as the group can maintain momentum in a key area.

Family offices double down on private credit and infrastructure during private equity slump, survey finds

Investment firms of the ultra-rich are changing their portfolios for greater liquidity and less risk.

Jim Cramer's top 10 things to watch in the stock market Thursday

Wall Street was heading for a higher open after the S&P 500 dipped slightly yesterday but remained near record highs.

CEOs share the 3 traits they want the most in job candidates: You ‘won’t be around very long’ without them

Job candidates who display curiosity, collaboration skills and ambitious thinking are more likely to get hired, according to these three CEOs.

Walgreens’ U.S. retail sales remain weak, but here’s why the stock is rising

The drugstore industry is facing competition from the likes of Amazon.com Inc., as well as pressure on pharmacy-reimbursement rates for prescription drugs.

Pixar's 'Elio' is emblematic of a bigger headwind for Hollywood

Disney and Pixar's "Elio" had a record low opening for the studio, but its performance is emblematic of a much wider trend in Hollywood: a reliance on sequels.

Jobless claims fall to 6-week low — no sign of surging layoffs

The number of people who applied for unemployment benefits last week fell to a six-week low, underscoring the reluctance of businesses to lay off workers even amid the tumult of ongoing trade wars.

Corporate America confident Trump's 'One Big Beautiful Bill' will be passed: CFO survey

The Senate and House are fighting over Trump's 'One Big Beautiful Bill' and deficit costs, but chief financial officers tell CNBC the tax cuts will become law.